Fast-tracking success:

How early-career financial professionals can thrive in Singapore’s evolving market

As Singapore cements its status as a global financial hub, early-career financial professionals are stepping into an industry undergoing rapid digital transformation, regulatory shifts and evolving client expectations. While this dynamic environment offers promising opportunities, it also presents challenges that demand strategic upskilling, adaptability and strong industry credentials.

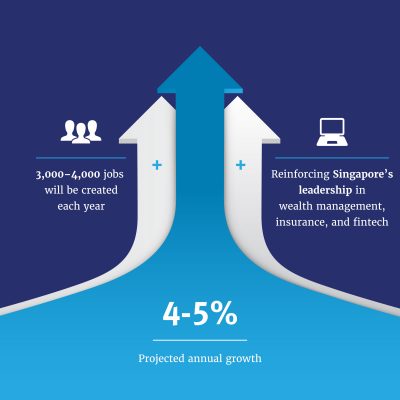

With the Monetary Authority of Singapore (MAS) projecting 4 to 5% annual growth in the financial sector, approximately 3,000 to 4,000 jobs will be created each year, reinforcing Singapore’s leadership in wealth management, insurance and fintech innovation (MAS, 2022). However, this expansion comes with increased expectations for digital competence, regulatory compliance and client-centric financial advisory.

This article outlines key industry trends, the in-demand skills needed for career acceleration, and how the Fellow Chartered Financial Practitioner (FChFP) Certification can provide a competitive edge in today’s market.

Singapore's financial sector outlook for 2025: A market in transition

Singapore’s financial services sector is evolving in response to global economic uncertainty and changing client expectations. In his 2025 New Year message, Prime Minister Lawrence Wong highlighted the challenges of rising inflation and economic instability, stressing the need for financial professionals to be agile, adaptable and proactive in navigating market shifts (PMO, 2025).

At the same time, financial institutions are making strategic adjustments to enhance digital services, strengthen regulatory compliance, and embrace sustainable finance. The MAS’ Financial Services Industry Transformation Map (ITM) 2025 is accelerating efforts to develop AI-driven wealth management, advance digital client engagement and promote financial literacy (MAS, 2022).

Dennis Tan, President of the Life Insurance Association (LIA) Singapore, has reinforced the importance of continuous learning and adaptation for financial practitioners. He outlined LIA’s key priorities for 2025, which focus on:

• Expanding financial literacy initiatives to enable Singaporeans to make informed decisions in wealth planning and risk management.

• Encouraging the adoption of digital tools in financial advisory, ensuring practitioners integrate AI-driven insights and digital platforms to improve client engagement.

• Strengthening regulatory standards and ethical practices to build long-term trust and confidence in financial professionals. (LIA, 2025)

For early-career professionals, these industry shifts highlight the increasing demand for specialised knowledge, digital proficiency and advanced advisory skills that go beyond traditional financial planning. To remain competitive, young practitioners must develop in-demand technical expertise, gain industry-recognised certifications such as the FChFP, and build a strong understanding of digital wealth management, regulatory compliance and evolving client needs. Those who proactively invest in upskilling will be well-positioned to succeed in Singapore’s rapidly evolving financial sector.

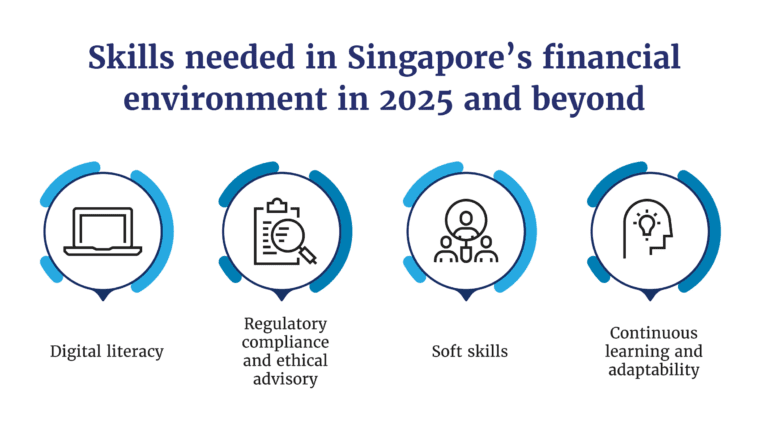

The must-have skills for financial professionals in 2025

Starting a career in financial services can be overwhelming. The industry is evolving faster than ever, and young professionals are expected to keep up with new technologies, navigate complex regulations and build trust with clients; all while proving their worth in a competitive market. The good news is the right skills can help financial practitioners stand out, gain credibility and accelerate their career growth.

One of the most critical skills today is digital literacy. Clients no longer rely solely on face-to-face meetings; they expect seamless, digital-first interactions, instant access to financial insights, and advisory services that integrate with their lifestyle. This translates to financial practitioners who must become fluent in digital tools, AI-powered analytics and fintech platforms. It’s not about replacing human connections but enhancing them and learning how to leverage data-driven insights in tandem, and personalised recommendations, automated routine processes, thus freeing up more time for meaningful client conversations.

Another major challenge is regulatory compliance and ethical advisory. With MAS tightening financial regulations, even a small misstep could mean losing client trust or facing reputational damage. Young practitioners must take the initiative to stay ahead of compliance requirements, understand governance frameworks, and ensure their financial advice is ethical, transparent and in the client’s best interest. Financial practitioners who can navigate compliance effortlessly will be trusted, sought-after and seen as reliable partners in wealth management.

Technical expertise alone is not enough. Soft skills such as negotiation, communication and relationship building increasingly thrive as competitive differentiators. Whether it’s guiding someone through their first investment, helping a family secure their financial future, or advising a business owner on risk management, financial practitioners need strong interpersonal skills to foster trust, provide clarity and offer reassurance in uncertain times.

To thrive in this new landscape, financial practitioners must embrace continuous learning and adaptability. The industry is changing, but so are client expectations. Those who are proactive in developing their skills, staying informed about market trends, and earning respected credentials.

Overcoming common challenges faced by early-career professionals

The truth is every successful financial practitioner started from zero. One of the biggest obstacles young financial practitioners face is earning trust from clients. Many people prefer working with experienced advisers, leaving early-career professionals feeling like they’re always one step behind. However, trust isn’t built on years alone; it’s built on expertise, integrity and delivering value.

One of the best ways to fast-track credibility is by obtaining recognised industry certifications like the FChFP. This qualification not only deepens financial knowledge but also signals to clients and employers that you’re committed to professional excellence and ethical advisory. Clients are more likely to trust practitioners who invest in their learning and demonstrate a solid understanding of financial planning, risk management and compliance.

Another key strategy is leveraging mentorship and client success stories. Young financial practitioners can share real-life case studies, testimonials, and success stories from their early experiences to showcase their expertise. Confidence and credibility grow with every meaningful client interaction, and over time, trust follows.

Another common challenge is helping clients set realistic expectations. In an industry where people often expect instant returns, quick wealth accumulation, or risk-free investments, managing expectations is both an art and a science. Young professionals can build strong client relationships by setting clear goals, explaining financial strategies in simple terms, and using data-driven insights to provide realistic projections.

Adapting to regulatory shifts is another critical challenge. The best practitioners actively integrate compliance into their advisory practice, ensuring clients receive ethical and fully compliant financial advice.

Why the FChFP Certification is a game-changer for career growth

In a competitive industry, where financial practitioners are constantly looking for ways to differentiate themselves, build credibility and attract high-value clients, the FChFP Certification is a powerful tool.

Unlike generic qualifications, the FChFP is designed specifically for financial practitioners. Accredited by the Asia Pacific Financial Services Association (APFinSA) and aligned with the Institute of Banking and Finance Singapore (IBF) standards, this certification provides a structured learning experience covering compliance, wealth management, financial planning and client advisory skills.

More importantly, the FChFP Certification is designed for practical application. The curriculum includes real-world case studies, ethical decision-making frameworks, and in-depth financial planning strategies that practitioners can immediately apply to their client interactions.

With specialised training in estate planning, risk management and investment suitability, FChFP holders gain the expertise needed to handle complex client portfolios, attract affluent clients and scale their practice by turning knowledge into results.

Your career growth starts now

If you’re serious about building a strong foundation, gaining industry credibility and positioning yourself as a top-tier financial practitioner, the FChFP Certification is the next logical step.

• Develop in-demand technical and soft skills

• Gain industry-recognised expertise in compliance, wealth management and financial advisory

• Learn from successful veterans and industry experts

• Stand out in the competitive Singapore financial sector

The FChFP Certification equips professionals with the latest regulatory knowledge, giving them the confidence to navigate compliance frameworks, cross-border taxation laws and governance structures. Financial practitioners can position themselves as trusted experts in a fast-changing market by staying ahead with the relevant knowledge and skills.

For young professionals looking to fast-track their success, enhance their marketability, and future-proof their careers, the FChFP Certification provides a direct pathway to credibility, career progression and industry recognition.

Seize the opportunity with the newly eligible SkillsFuture Credit and IBF funding and take control of your career and explore the FChFP Certification today. Your future as a trusted, high-performing financial practitioner starts now.